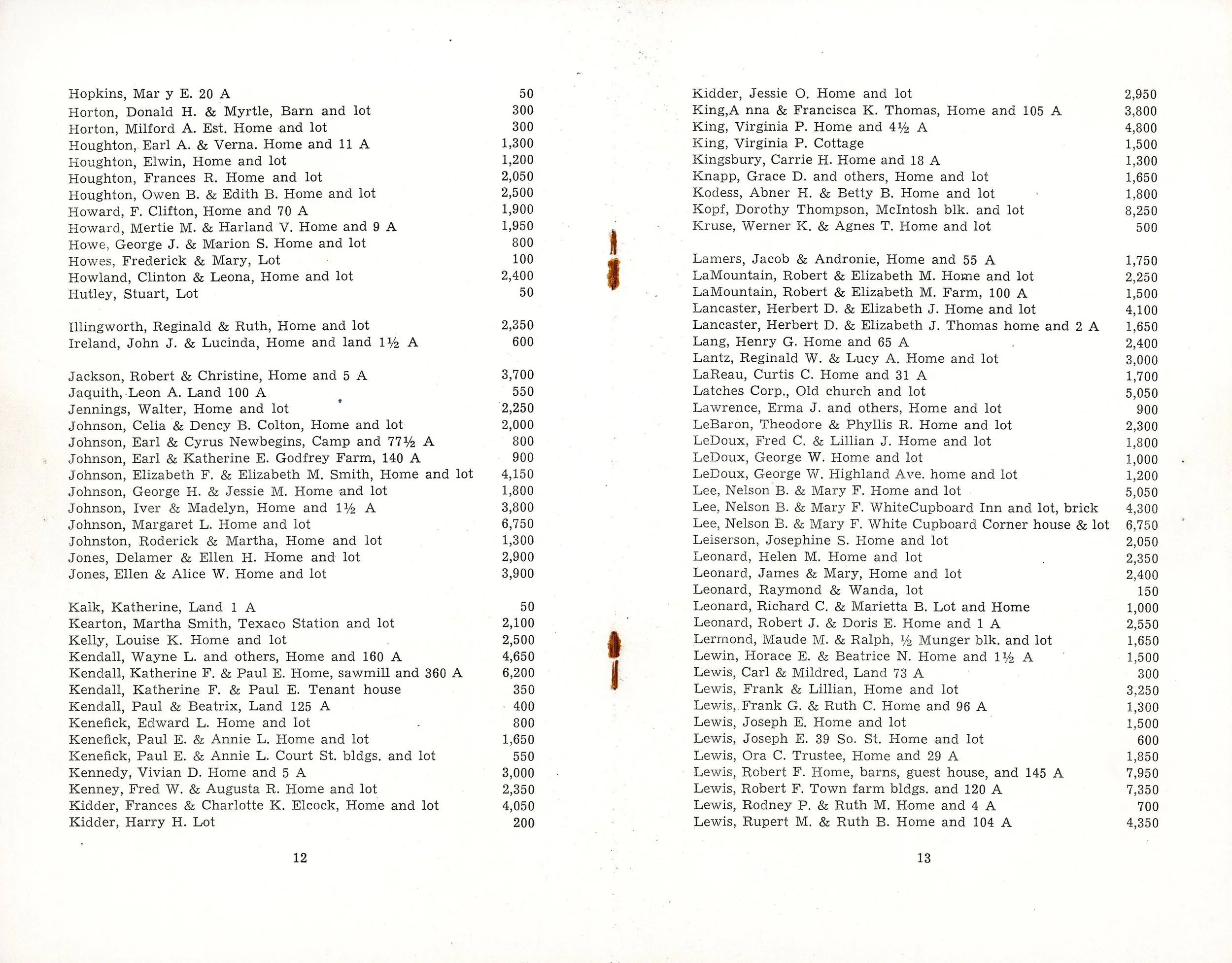

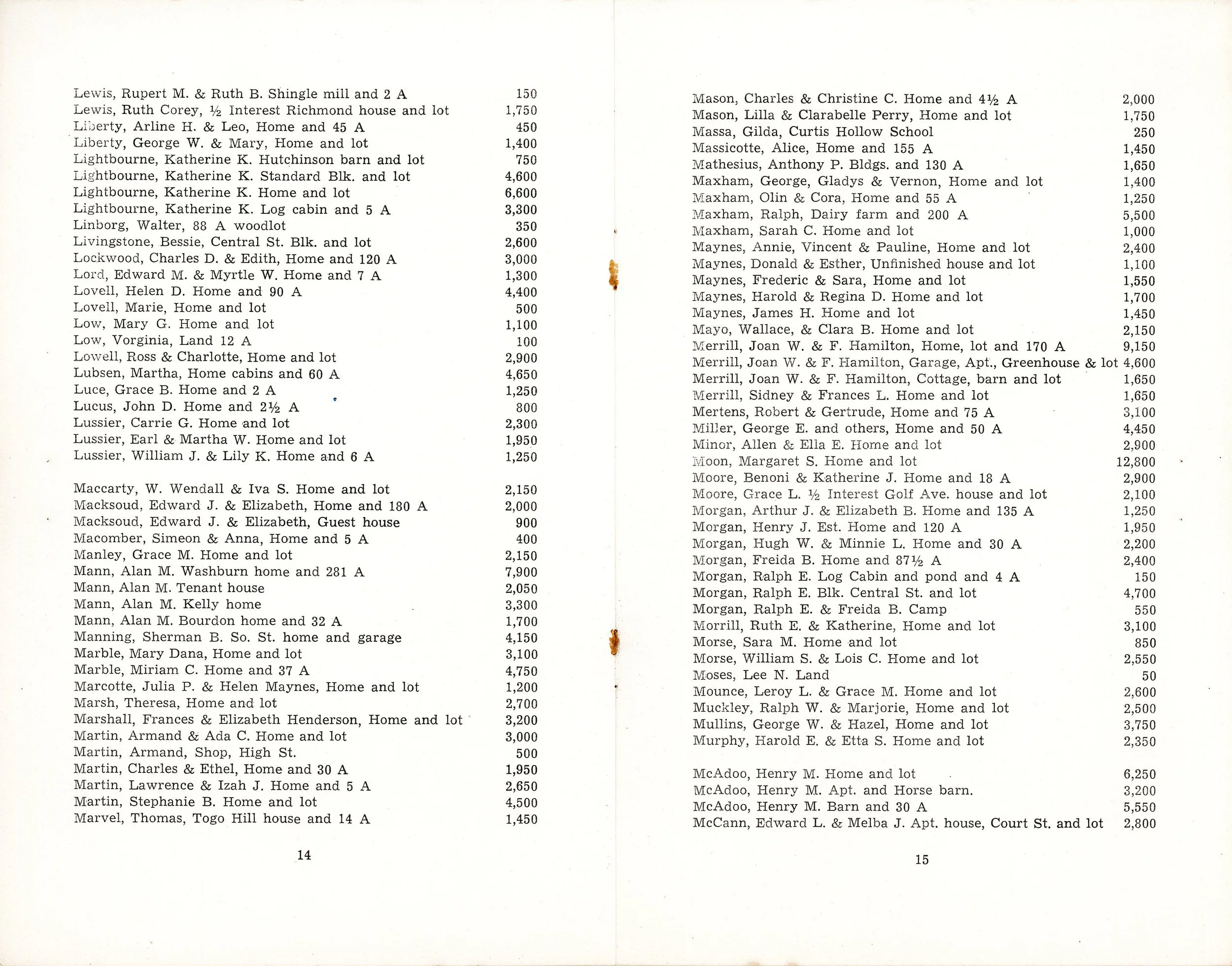

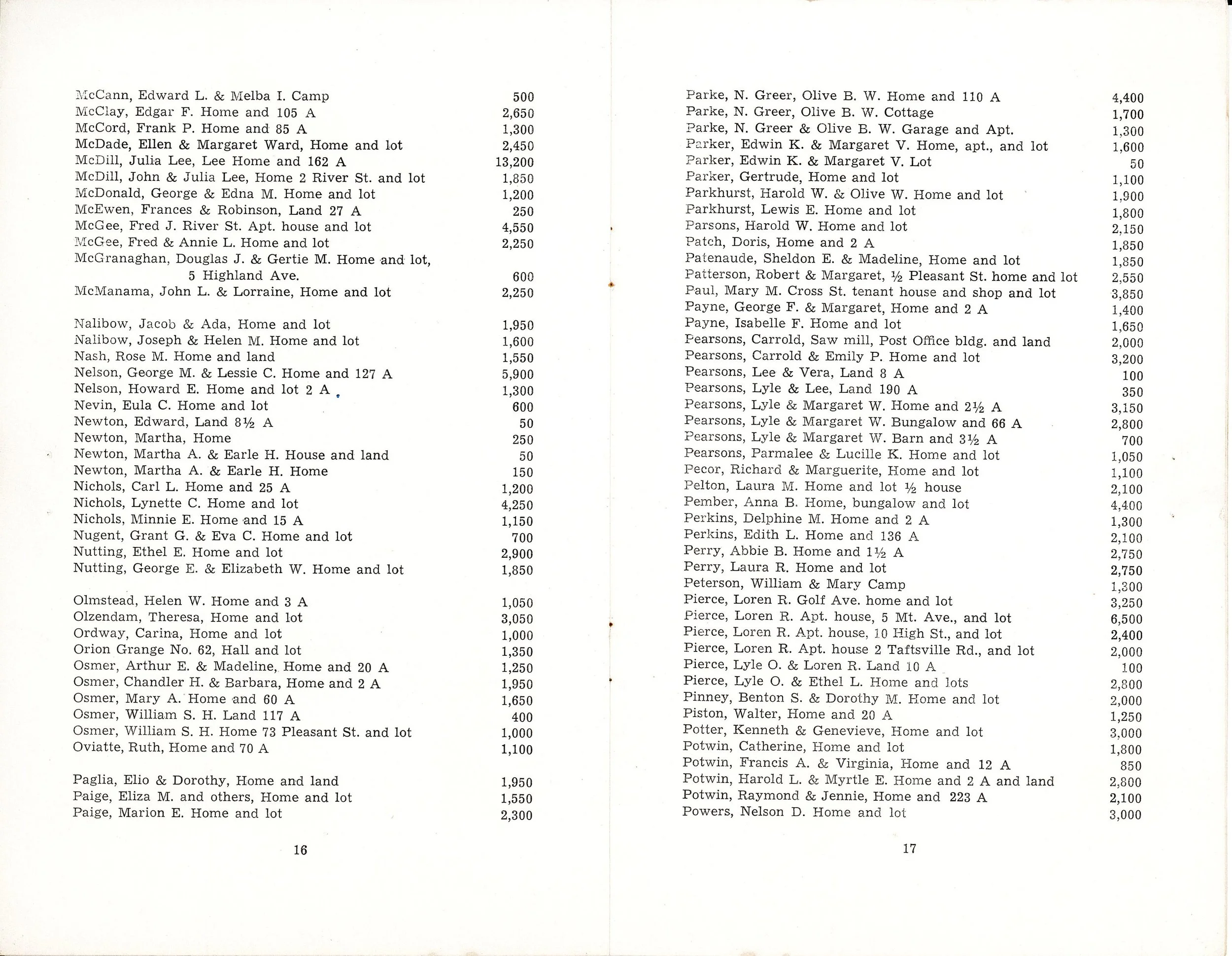

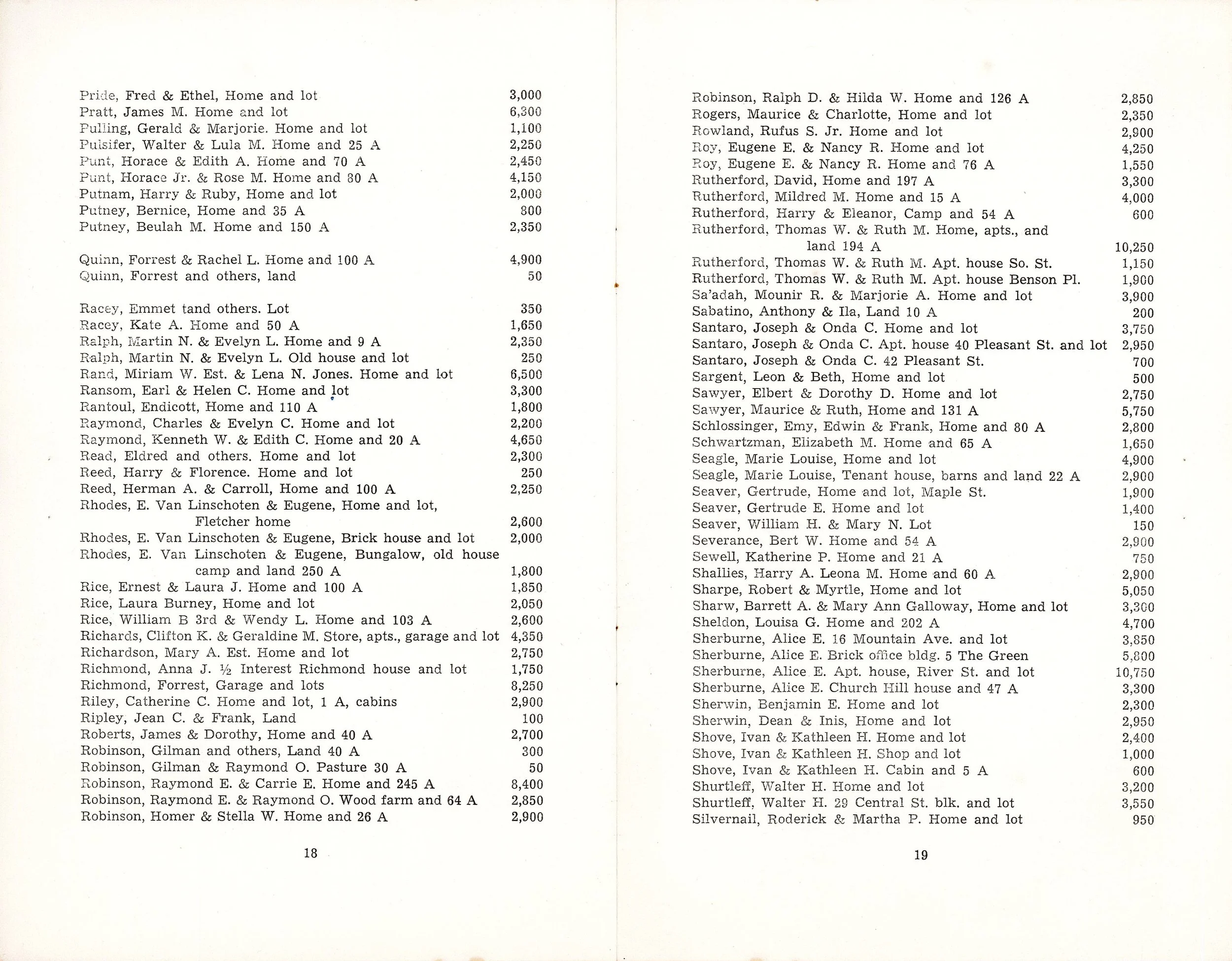

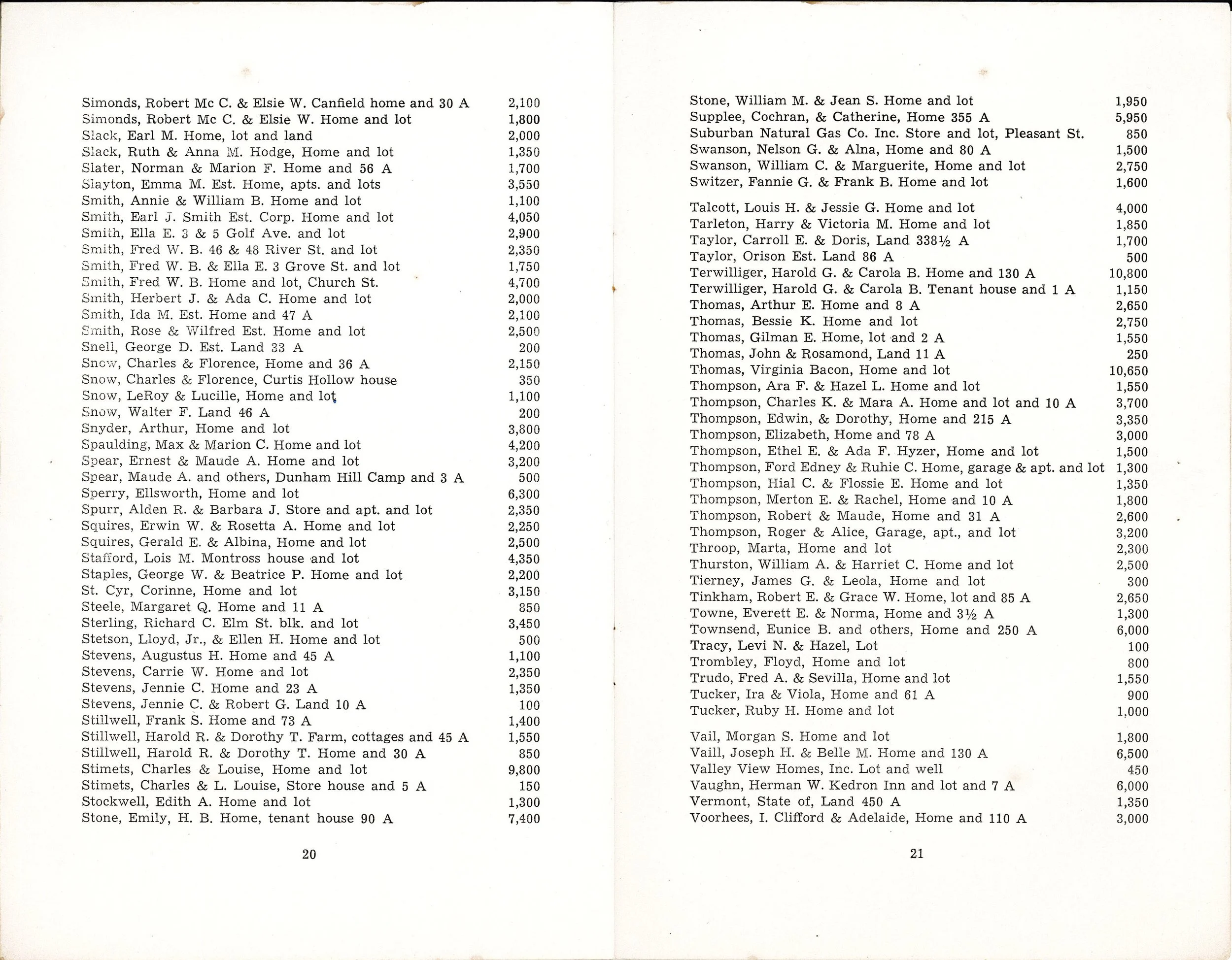

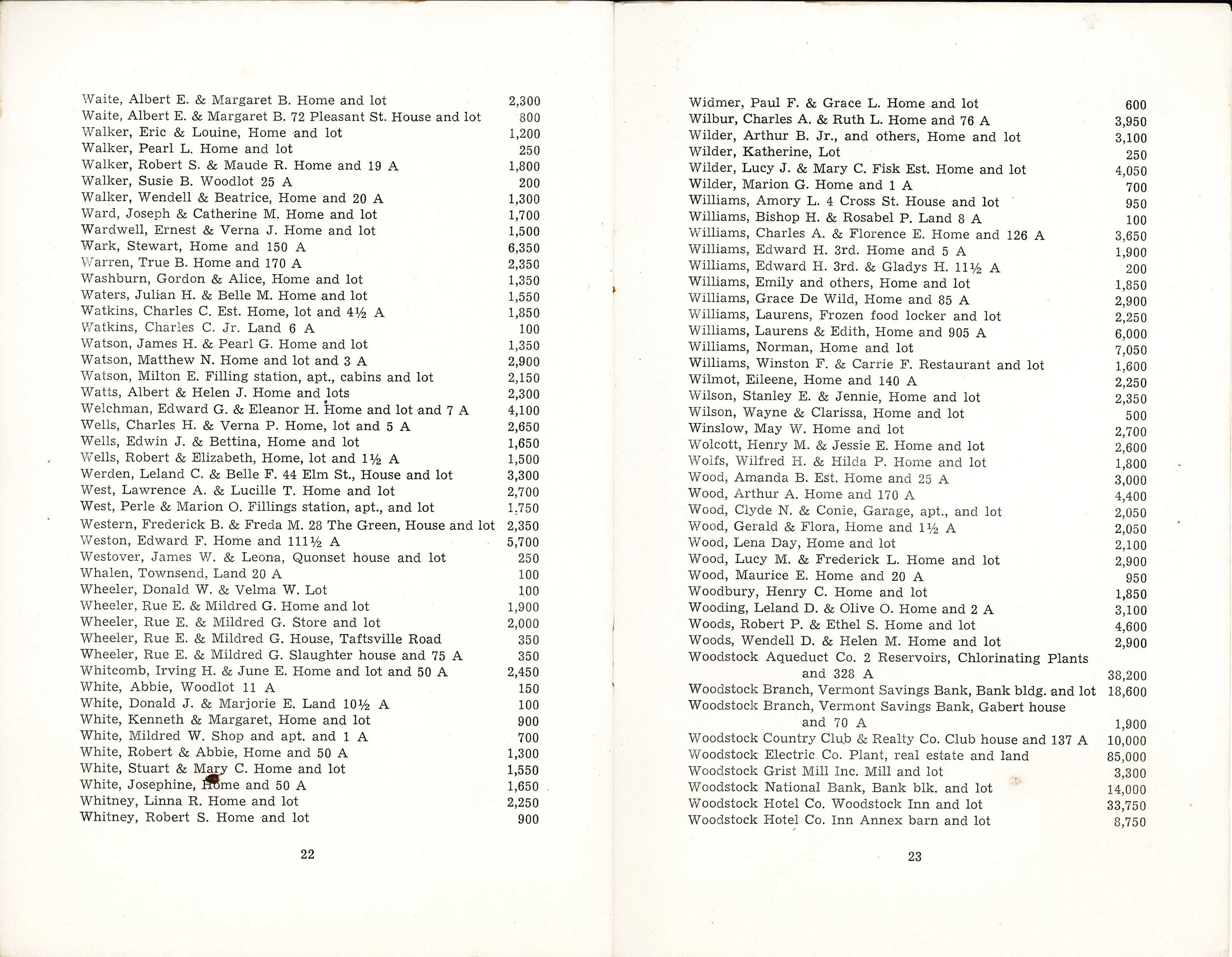

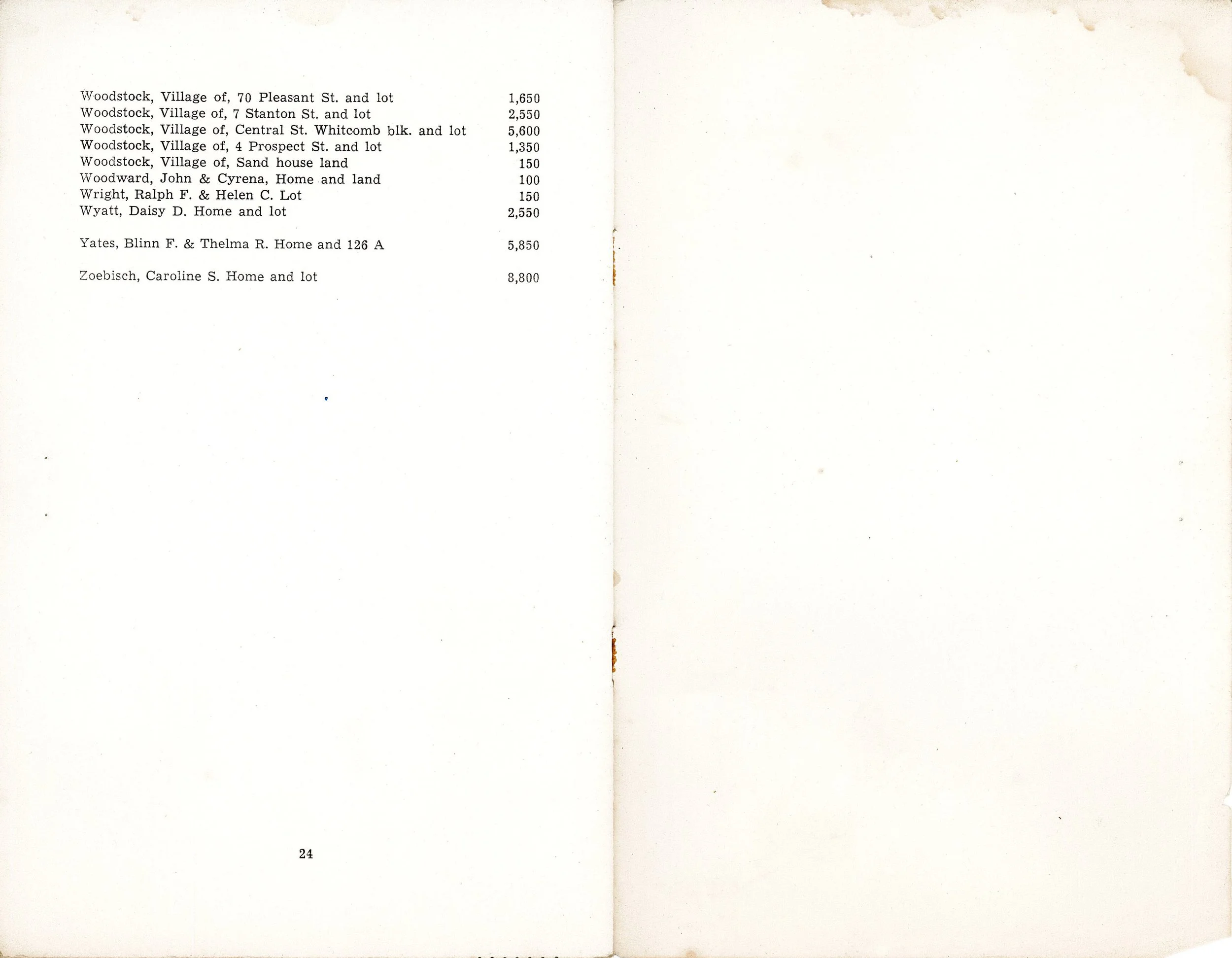

1950 Quadrennial Appraisal

In 1950, the Town of Woodstock published a Quadrennial Appraisal booklet with updated property valuations.

A week later, the Vermont Standard ran an article entitled "Week's Best Seller.” In the article, the Standard noted: "There can be no doubt about it - best sellers of the Literary Guild, Book-of-the-Month Club and other groups are nothing compared to the avid reading of Woodstock's quadrennial appraisal booklet when it was published last week. We haven't been around other towns to listen but we suspect that the roars which went up were quite similar to those we've heard in Woodstock. The listers have been almost afraid to walk down the streets since the figures were released..."

Why the great uproar? While some property’s valuations went down, many went up substantially, particularly among the middle-income group. The Standard notes: “Naturally, it comes as a rude shock to a householder to receive a hike of a thousand dollars, or to have it doubled. But before he [the home owner] starts hitting the roof, he should stop and consider whether or not his former valuation was equitable. Probably, we will be threatened with horsewhipping for saying this, but we are of the opinion that many of the “middle-income” home owners have been “getting away with murder” for years on their appraisals. We recall looking up a number of five and six room houses which were appraised for anywhere from $900 to $1,400 - and which would have sold, even before the inflation, for $4,800 and up.” The editors of the Vermont Standard end by saying that property owners who feel that their property valuations are unfair should talk to the listers and present their cases.

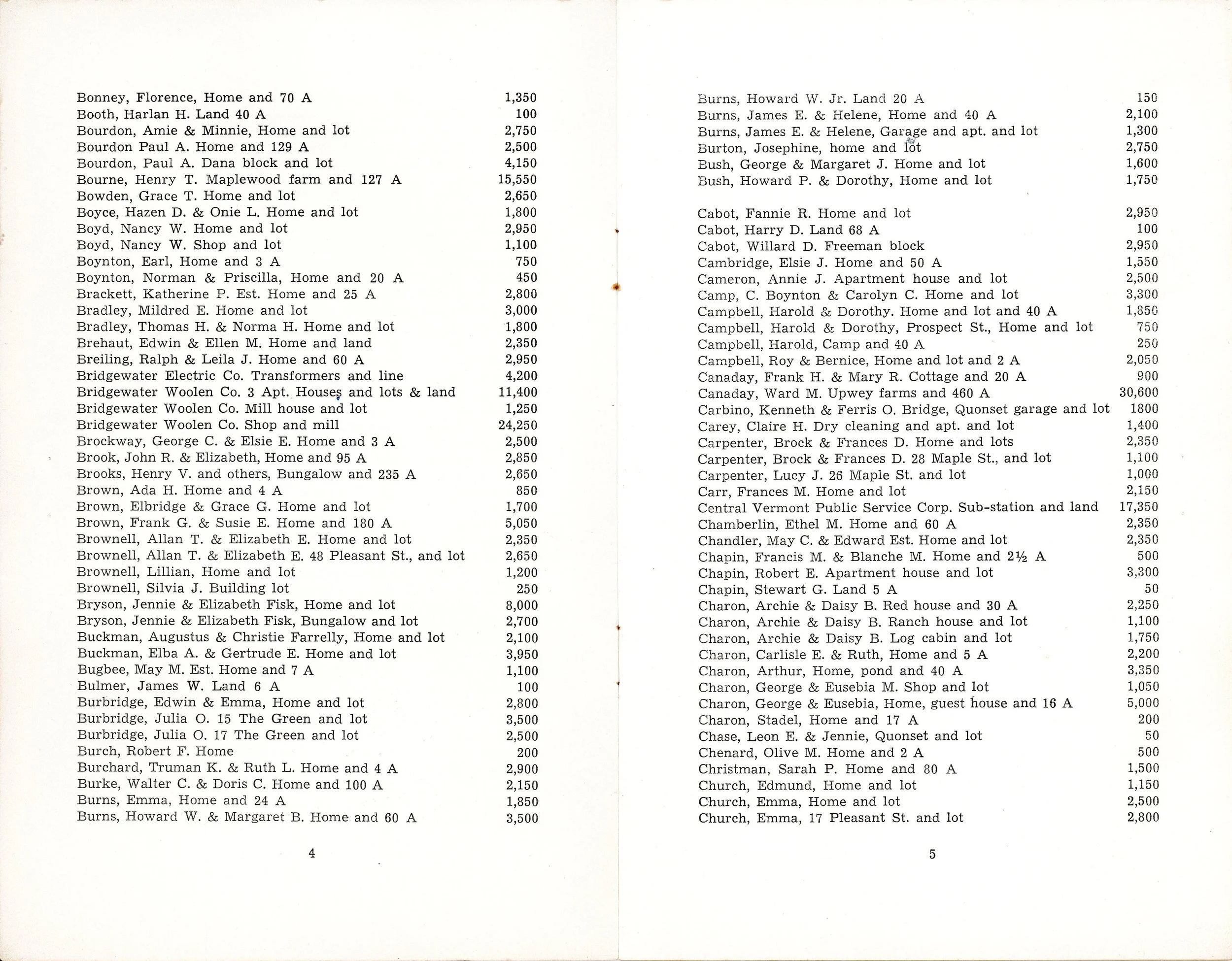

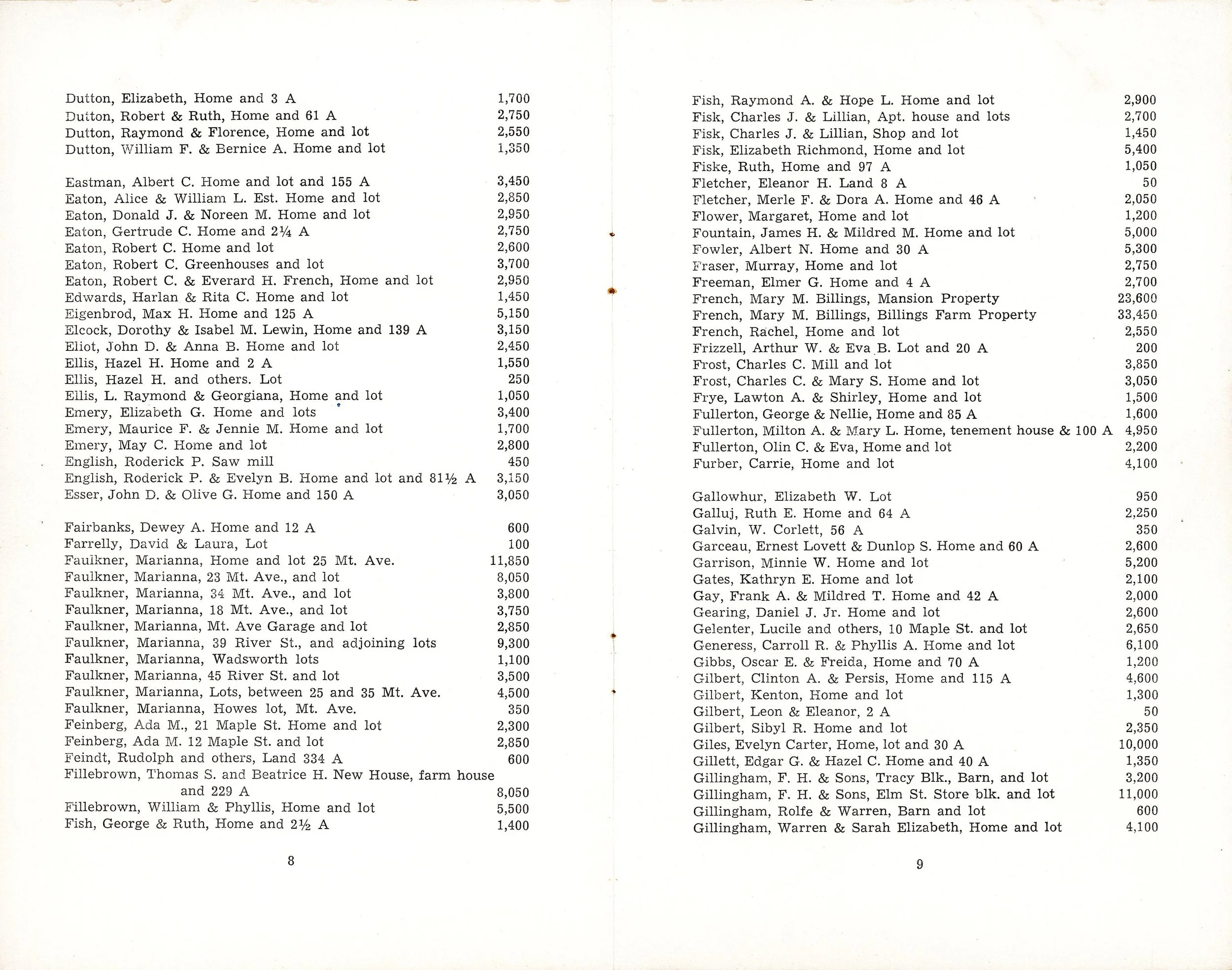

A copy of the 1950 Quadrennial Appraisal booklet that caused the uproar is below. The property valuations shown in this booklet are 30 percent of what the listers in 1950 believed the actual value of the property to be. While some of the properties do have addresses associated with them, many are only identified by the owner’s name, so to see your property’s valuation for tax purposes in 1950, you would need to know who owned the property at that time.